A few months ago, we posted a blog post about the general reasons that can cause the peso to rise or fall against the dollar. However, its appreciation in 2023 has been around 14%, with ranges of $16.70 to $16.90 per dollar seen during the month of July. This is noteworthy, as we have returned to levels of seven years ago, a scenario that was unimaginable not long ago.

When reviewing the comments of analysts and chief economists at the main banks of Mexico and the United States, most agree on one main reason: the balance of payments.

The balance of payments is a measure of the inflow and outflow of dollars into the country through the current account (the difference between exports and imports) and the financial account, which measures the flows of foreign direct and indirect investment in Mexico and vice versa.

In particular, the financial account is responsible for the inflow of flows or dollars that enter the country. If this account grows in volume, it can cause the exchange rate to fall, as there will be a greater supply of dollars in the market. When the financial account decreases, there is an outflow of dollars, which causes an increase in the price of the dollar against the Mexican peso.

Many news stories have talked about nearshoring, remittances, and investment in CETES or government bonds due to the effect of the central bank’s interest rate as the drivers of dollar inflows. This claim can be translated as correct if we can confirm the figures for foreign direct investment (FDI), portfolio investment, remittances, and tourism, which are synchronized in a positive way.

Regarding the myths or misinformation that exist around a solid peso, they are related to the current economic and public policies of the government. This is an absolute lie, as the government has not been the main promoter or creator of conditions for greater capital attraction. The conditions are derived from the financial behavior of global markets (the mood comes from the private sector as such), the weakness of the dollar internationally, and how attractive Mexico is currently for investment in production chains compared to other emerging countries (Brazil, India, Russia, Chile, etc.).

Mexico also has an attractive interest rate, a phenomenon of remittances that occurs due to the great maturation of Mexican communities in the United States who send resources to their families, and the factor of tourism, since Mexico is attractive for citizens of North American, European, and South American origin.

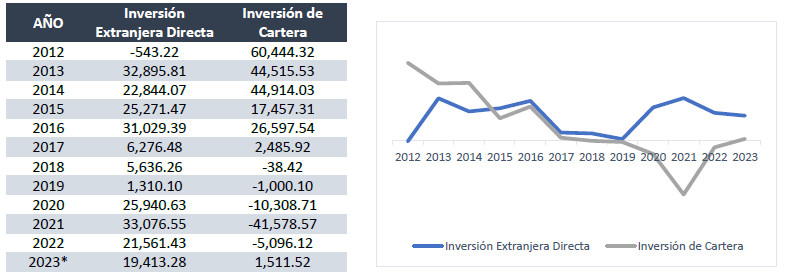

Table – Graph 1. Evolution of Investment Flows in financial balance of payments expressed in millions of dollars.

From 2012 to 2016, we can see a relatively stable period with a slight decrease in investment entering the country. After 2016, we saw a considerable decline in both FDI and IC, which coincides with the data on the increase in the price of the dollar and the lowering of interest rates by Banxico.

After 2020, contrary to what was believed in the pandemic stage, FDI began to accelerate its pace to compensate for the decline in IC. Although in general terms, the result was an overall increase in investment by foreigners, a trend that is still accelerating. FDI can give us the measurement of the nearshoring effect and portfolio investment is a good parameter for the entry of capital due to the attractiveness of rates and the financial market in Mexico. Both are having an upward trend and in the measurement we have until March 2023, almost 90% of all the flow generated in FDI that was generated in 2022 was already achieved.

Table – Graph 1. Evolution of current account balance income in millions of dollars

Contrary to the topic of investment, both remittances and income from the spending of tourists visiting Mexico, the curve has been completely upward; in 2022, tourism was able to recover to pre-pandemic levels, which generates a stable outlook in both areas.

Will the dollar be able to decrease below $16 pesos?

First, we will have to observe the data represented at the end of June, which will be reported in August by the Bank of Mexico, to confirm the evolution that they are still having and to create a clearer perspective.

Taking into account the Banxico survey of private sector expectations, at the end of June, the consensus forecast is to close at a price of $18.33 pesos per dollar, which gives us an idea that there will be an upward adjustment that may be lower than that figure.

Considering the financial expectations of the global market in which Mexico could start to lose ground due to the interest rate differential (being less attractive to investors) versus the United States and Europe, it could be one of the adjustment routes in favor of the dollar, which makes me think definitively that the dollar will no longer be able to depreciate further, although there also does not seem to be any arguments to consider its strengthening in the following weeks, being in a range that oscillates at $17.00 MXN per Dollar.

For savers and investors who consider investing in dollar based assets, we are currently in the best opportunity in the face of a possible eventual rebound and that it is unlikely to be able to decrease further.

For any further information on the economy, markets and personal finance, please contact me directly through:

Email: agarcia@hedeker.com

LinkedIn: Alberto García Medina

GRUPO HEDEKER is an investment advisory firm specializing in international investments with the aim of forming, protecting, and growing the assets of savers and investors in our country. Contact us to learn more about what we can achieve.