In the weeks leading up to this, we published about the impact of the most spectacular films of the year: The Little Mermaid and Mario Bros. To this list, we will now add Barbie, which has been a global trending topic from weeks prior to its release up until this summer. The frenzy caused by Barbie has been among the most impressive things we can see in our daily lives: ranging from memes to themed parties; people can be seen dressed as the character in the streets, and companies have added related advertising as a central part of their campaigns. In these new business strategies, companies have found a common denominator: reviving characters from the past that have passed through generations, which translates into a potential for product consumption that includes audiences of different ages. An example of this is Barbie as a brand: a doll that is present in the minds of young girls, but also in teenagers and young adults who don’t necessarily buy the “doll” to express a connection. Nostalgia and memory become the best allies of these types of strategies: encouraging consumption among a generational audience that will fuel their desire to “connect” to the moment. Under this premise, Mattel, through its iconic doll, is embracing a new strategy that allows it to be present among new generations, whose entertainment preferences are rooted in new technologies. This is the main reason why the toy industry has weakened and “barbies” in particular have taken a back seat when they used to be the top preference for any girl. Who will be the main beneficiary of this great effect? Undoubtedly, Mattel, the owner of the iconic toy, even though the movie is a live action and does not have an entirely child-oriented plot. Next, we will evaluate the historical and current performance of Mattel’s stock, with the aim of interpreting the possible impact that the Barbie movie has had in recent weeks.

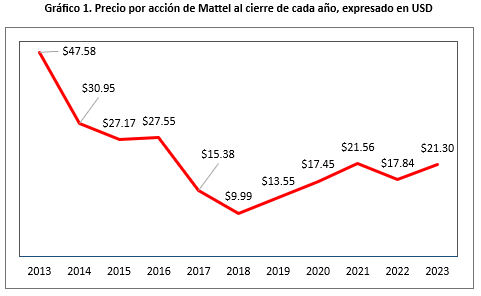

Reviewing the information from the previous chart, we can confirm the abrupt market decline of Mattel since 2014, hitting its lowest point in 2018. The reason for this is a decline in product sales, as we mentioned earlier. We observe a significant rebound in 2023, though it falls short of its prime years.

How much does the sale of Barbies represent for the company?

Barbie can be considered a brand in itself; in financial terms, along with Fisher Price and Hot Wheels, these three brands represent the majority of the company’s sales and revenue. However, Barbie is a cultural icon, regardless of the controversy it may generate in the context of beauty and stereotypes. Intangibly, it is Mattel’s most important asset.

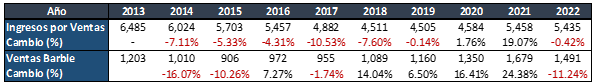

Very similar to what was reviewed in the previous chart, Mattel’s total sales reached their lowest point between the years 2017 and 2019, coinciding with the decline in the stock price. However, contrary to what many believe about toys no longer being a viable business, Mattel has actually stagnated, rather than completely deteriorated.

In the Barbie sales category, we can identify that, on average over the last 10 years, it represents 22% of the total direct sales of the entire group, serving as a financial pillar; Barbie sales revenues have been increasing since 2018.

Considering that there’s a resurgence in the Barbie division worldwide, could the movie be the factor that gives a boost to the company? Will more Barbies be sold in the coming months?

I would venture to confirm that yes; today, parents who witness this phenomenon will consider purchasing Barbies for their daughters; girls and teenagers will want merchandise related to the Californian doll, and surely Mattel could experience its best year in sales in 2023 in over a decade, or even more.

How much has the company appreciated in the current year?

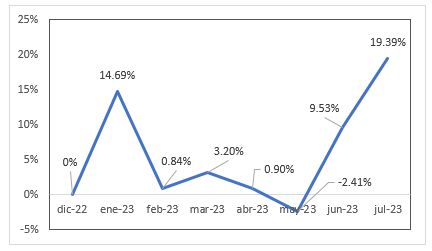

Let’s remember that the market in general bases or considers its decisions on expectations, and this movie has managed to awaken those expectations, considering the potential benefits for the brand.

Reviewing the information, we can confirm that, starting from June, Mattel’s stock has experienced a significant rebound, and this cannot be dismissed as a mere coincidence, especially considering the impact of the movie during these dates.

Will Barbie revive Mattel? I believe not; it’s technically impossible to see the brand’s power returning to the levels it reached in the 1990s when its stock was trading at around $40 USD. Therefore, I wouldn’t base my expectations on that, and I doubt we could see the stock price returning to those levels.

I maintain the hypothesis that, beyond the well-crafted and existing marketing phenomenon on social media, Barbie will continue to dominate people’s desires and preferences in a society absurdly driven by momentary trends. Despite the figures placing it with a box office revenue exceeding $1 billion and its ongoing trend, it will be the highest-grossing movie of the year.

For any additional topics related to economy, markets and personal finance, please contact me directly through:

Email: agarcia@hedeker.com

LinkedIn: Alberto García Medina

GRUPO HEDEKER is a financial advisory firm that specializes in international investments. Our goal is to build, protect and grow the wealth of savers and investors in our country. Contact us to learn more about what we can achieve.