When we talk about interest rates, there are always comparisons because any investor or saver prefers the rate offer that pays more. However, it’s crucial to evaluate which currency retains more value to determine the most profitable investment. The reference of yield rates is reflected through debt securities known as CETES or Government Bonds in Mexico, and the US “treasures,” which have different rates.

As of the close on Wednesday, 20th September, the USA had an interest rate of 5.25% – 5.50%, compared to Mexico’s 11.25%. Considering the bonds issued by both countries are based on these rates, it might seem more profitable to invest in Mexico at first glance. However, the key to understanding this concept lies in the currency: US dollars versus Mexican pesos. Which currency offers more purchasing power?

Purchasing Power Parity (PPP) answers this question. It is a comparison of the exchange rate between the Mexican peso and the US dollar, determining if the same amount of pesos can buy the same goods as a similar amount of dollars.

We’ll use the famous Big Mac Index to connect both concepts, representing the cost of a burger in different countries in dollars. The goal is to buy the iconic burger with as few dollars as possible compared to the USA.

If the burger costs more in Mexico, indicating that more dollars are needed, it means the peso is overvalued. Conversely, if it costs less, it signifies a weaker peso, helping us measure PPP.

For Mexico, PPP decreases when the dollar-to-peso exchange rate rises, indicating a higher cost to acquire imported goods. When the reverse occurs, the country’s PPP strengthens, making imported goods cheaper.

In a scenario where the Mexican peso depreciates, a higher interest rate is of little use, as the purchasing power against the dollar is lost. Interest rate parity could tilt in favour of the dollar: with a lower interest rate, I get a higher real interest yield as the exchange rate evolves in favour of this currency.

In a nutshell, you can buy more Big Macs investing in dollars, even with a lower interest rate. If you invest in Mexican pesos, you’ll buy fewer burgers despite Banxico offering a better interest rate.

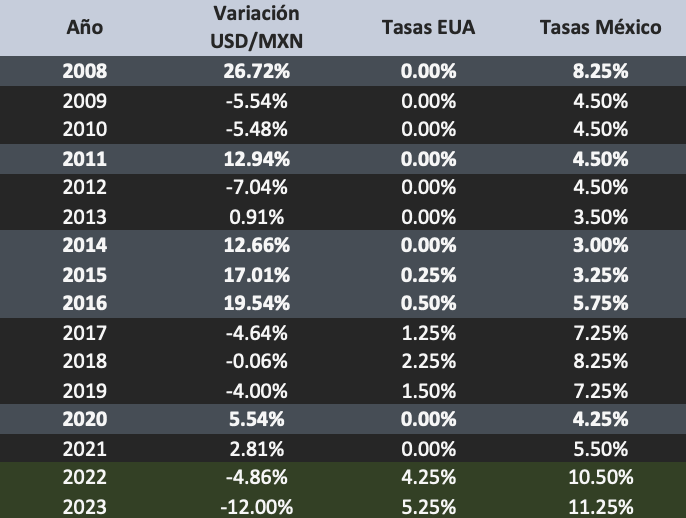

Generally, the exchange rate has shown an upward trend in medium and long-term cycles (3 years onwards) in favour of the US dollar. Interest rates in both countries have followed a similar trend of increasing and decreasing rates, though rates tend to be higher in Mexico.

So, how can we determine if the yield in the USA is more profitable than in Mexico despite a lower interest rate? We can quantitatively know this by comparing the evolution of rates and exchange rates between the two countries over the years.

Next, we will show the rate differential and compare it with the exchange rate.

Table 1. Comparison of exchange rate, reference rate of the USA and Mexico [Note: The actual data is not provided in the original text.]

This comparison allows us to make informed decisions about where to invest, taking into account both the interest rate and the currency’s purchasing power.

For any additional topics related to the economy, markets, and personal finances, contact me directly through: Email: agarcia@hedeker.com LinkedIn: Alberto García Medina

HEDEKER GROUP is a consultancy firm specialised in international investments, aiming to educate, protect, and grow the savings and investments of our country’s citizens. Consult us to learn more about what we can achieve.