A trending topic is the famous super peso that has managed to rebound to levels of several years ago, which can mean a great opportunity to take advantage of this positive change in investments, savings, international trade, etc.

REASONS FOR WHICH THE EXCHANGE RATE CAN WEAKEN OR STRENGTHEN

1) INTEREST RATES. When interest rates are higher in Mexico than in the rest of the world, it becomes more attractive to invest in Mexican debt, which generates a significant inflow of dollars; in the opposite case (rates in Mexico decrease), it becomes more attractive to invest in other countries and the peso-dollar exchange rate rises.

2) COUNTRY RISK. This is the rating Mexico receives based on its financial situation, which is provided by different international agencies. Currently, Mexico’s rating is an average of BBB, which is acceptable; if this rating is lowered, the peso is disadvantaged because investing in our country is not attractive; otherwise, the peso rises against the dollar.

3) GEOPOLITICAL. The international context is the factor that generates the greatest volatility; when there are situations of global tension and uncertainty, the dollar is usually the currency most sought after by savers and investors in order to protect their assets.

4) TRADE BALANCE. As Mexico is a strong exporter and importer, particularly with the United States and Canada, any movement that affects business or flows abroad has repercussions on the exchange rate. Mexico commonly imports more than it exports, which generates an imbalance in the country’s debt.

5) PUBLIC POLICIES. Situations such as elections, security, and decisions on the country’s economic direction are seen by investors, businessmen, and foreigners from a negative or positive point of view; when opinions and results are negative, the dollar strengthens; in cases of stability, the dollar behaves with moderate growth.

WHAT HAPPENS TO THE DOLLAR IN THE MEDIUM AND LONG TERM?

Experience tells us that the dollar always ends up being higher than the peso, in spite of the latter’s good performance. The dollar is the reserve currency and the most traded currency in the world, and this relationship is determined by the economic activity of the US, which is the most important at a global level.

A trending topic is the famous super peso that has managed to rebound to levels of several years ago, which can mean a great opportunity to take advantage of this positive change in investments, savings, international trade, etc.

REASONS FOR WHICH THE EXCHANGE RATE CAN WEAKEN OR STRENGTHEN

1) INTEREST RATES. When interest rates are higher in Mexico than in the rest of the world, it becomes more attractive to invest in Mexican debt, which generates a significant inflow of dollars; in the opposite case (rates in Mexico decrease), it becomes more attractive to invest in other countries and the peso-dollar exchange rate rises.

2) COUNTRY RISK. This is the rating Mexico receives based on its financial situation, which is provided by different international agencies. Currently, Mexico’s rating is an average of BBB, which is acceptable; if this rating is lowered, the peso is disadvantaged because investing in our country is not attractive; otherwise, the peso rises against the dollar.

3) GEOPOLITICAL. The international context is the factor that generates the greatest volatility; when there are situations of global tension and uncertainty, the dollar is usually the currency most sought after by savers and investors in order to protect their assets.

4) TRADE BALANCE. As Mexico is a strong exporter and importer, particularly with the United States and Canada, any movement that affects business or flows abroad has repercussions on the exchange rate. Mexico commonly imports more than it exports, which generates an imbalance in the country’s debt.

5) PUBLIC POLICIES. Situations such as elections, security, and decisions on the country’s economic direction are seen by investors, businessmen, and foreigners from a negative or positive point of view; when opinions and results are negative, the dollar strengthens; in cases of stability, the dollar behaves with moderate growth.

WHAT HAPPENS TO THE DOLLAR IN THE MEDIUM AND LONG TERM?

Experience tells us that the dollar always ends up being higher than the peso, in spite of the latter’s good performance. The dollar is the reserve currency and the most traded currency in the world, and this relationship is determined by the economic activity of the US, which is the most important at a global level.

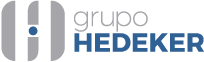

As can be seen in the chart above, the exchange rate has almost doubled in the last 20 years and about 50% more from 2013 to 2022 despite a very stable exchange rate in the last 5 years.

WHY DID THE EXCHANGE RATE RISE SO MUCH FROM 2013 TO 2016?

It was the perfect storm that weakened the peso: interest rates in Mexico were unattractive (in a range of 3.5% to 5%), gasoline prices began to rise, political instability with the US from the campaign with Donald Trump until his arrival brought uncertainty with promises that would harm the economy coupled with one of the most important electoral cycles in history (the political left won for the first time).

WHAT GENERATED STABILITY IN THE EXCHANGE RATE FROM 2017 TO 2022?

One key factor was that there was too much speculation on the peso in 2016, when Donald Trump’s victory created a bubble around the negative effects that Mexico would have, a situation that not only did not happen, but on the contrary, the trade relationship with the US improved.

The second factor was that in 2018 there was a fall in stock markets around the world due to the increase in interest rates in which Mexico reached the range of 8.25% being very attractive for investors.

The COVID-19 pandemic could have been the scenario for a weakening of the peso coupled with the fall in interest rates, however, the outlook was more severe with China and Europe putting the focus particularly on an international market that punished the EURO.

WHEN IS IT CONVENIENT TO INVEST IN DOLLARS?

Thinking in a medium – long term moment, there is always a good moment, however, there are better opportunities within time.

Therefore, the suggestion is to invest when the exchange rate is stable or is in periods of decline as is the current context and avoid it when the dollar becomes volatile upwards as it happened in the COVID-19 pandemic when there were people who transferred resources at an exchange rate between $23 and $25 x dollar.

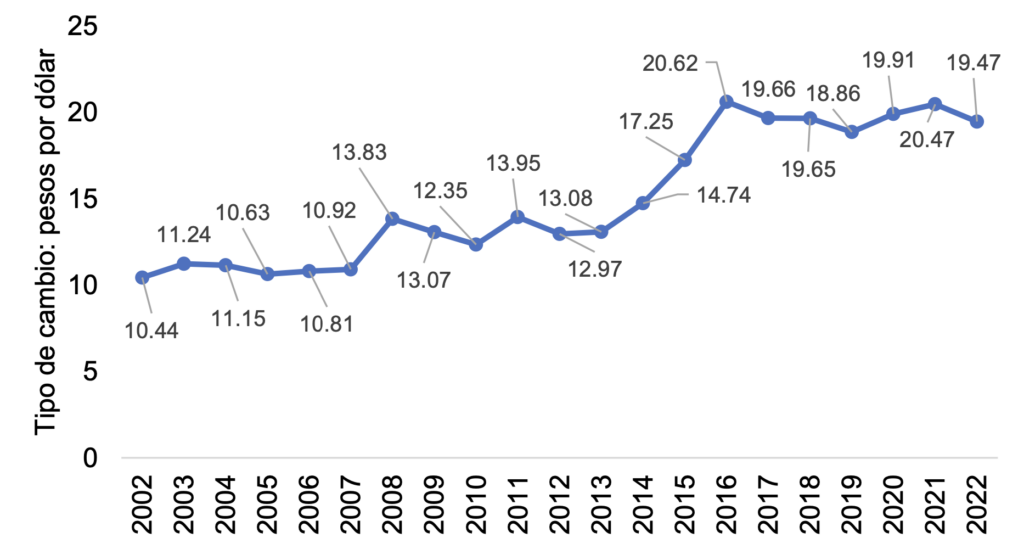

In the following graph, we will visualize a comparison of the minimum price of the exchange rate (in gray color) and the maximum during the same year (in dark blue color).

Within the same year there can be a lot of volatility, for example: in 2016, upon learning of Trump’s victory as President of the United States, the dollar was quoted at $21.91 pesos per dollar, when the average exchange rate was $17, that is, in a few weeks it grew by 28%, making investors with a previous entry to this currency profitable.

In the COVID-19 pandemic, in the face of great global uncertainty, the exchange rate accelerated to the historical maximum of $25.12 ppd but quickly decreased as it was a matter of global uncertainty without being particularly related to Mexico.

In spite of the fact that the exchange rate has gone down in the 2021 and 2022 periods, an important opportunity gap has been created to make an investment in dollars. The dollar has traded in minimum ranges of 19.24 and 19.58, so an eventual rise that positions the dollar in ranges of $21 and $22 will mean a good profitability for savers and investors.

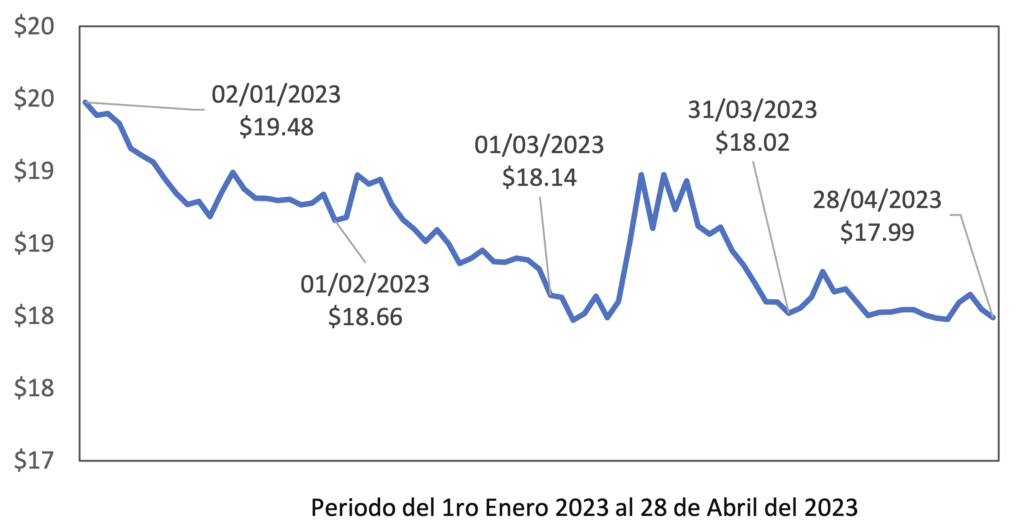

WHAT HAPPENS IN 2023, AND WHY DOES THE DOLLAR CONTINUE TO FALL AGAINST THE MEXICAN PESO?

Basically, positive factors have come together to have a super peso and also negative factors to have a weak dollar in the world; the famous NEARSHORING which is basically the direct attraction of foreign private capital to our country and the historical remittances from the USA to Mexico plus the high interest rates have generated a much greater flow of dollars into the country than expected.

The exchange rate is approaching a range of 2016 historical lows, which means it can be relisted as a multi-year pullback.

CAN THE DOLLAR CONTINUE TO FALL FURTHER IN THE COMING MONTHS?

We could say that it is almost impossible for that to happen, because at some point remittances from the US to Mexico will decrease, rates will also have an adjustment and the nearshoring effect will slow down. Technically we are entering the most prosperous stage of the peso and that will have to end.

We must also remember that Mexico and the U.S. will begin an electoral process in 2024, which by its very nature carries channels of uncertainty that make the exchange rate more volatile, with a rebound in favor of the dollar.

Having an exchange rate in a range of $17 and $18 pesos per dollar can mean the most attractive entry to invest in this currency and as history shows, as soon as there are at least 3 of the above-mentioned factors that play against the peso, it will only take weeks to return to exchange rates close to $20 per dollar and 2024 could have the perfect ingredients.

Fuentes: Tipo de cambio, elaboración propia con datos de Banco de México